Table of Contents

- What is water damage?

- Is water damage dangerous?

- Water damage in an apartment – who is responsible?

- Tenant negligence water damage in a rental property

- Tenant did not report water leak

- Does landlords insurance cover water damage?

- Does renters insurance cover water damage?

- Landlord responsibility water damage in rental property

- Landlord responsibility for flood damage

- Landlord insurance water damage

- Difference between Landlord Insurance and Homeowners Insurance

- Good Life Property Management Fast Track Repair Process for Water Damage

- Rent Credit

- Frequently Asked Questions

What is Water Damage?

Water damage is harm or destruction caused by water entering areas where it is not supposed to be. It can be caused by a variety of sources and can manifest in different ways. The most common examples of water damage include:

- Leaking roof

- Plumbing leaks

- Appliance malfunctions

- Poor drainage

- Flooding

- Sewage backup

- Condensation

- Tenant negligence

- HVAC system issues

- Frozen pipes

Is water damage dangerous?

Water damage itself is not inherently dangerous, but it can lead to various hazards and health risks if not promptly and properly addressed. The severity of these risks depends on the extent of the water damage, the source of the water, and how quickly it is mitigated.

Some potential dangers associated with water damage include structural damage, mold and bacterial growth, electrical hazards, water contamination, and pest infestations. In situations where mold and mildew have gone unaddressed, mold can start to develop within 24-48 hours of water exposure, and this can impose a serious health risk to tenants. In particular, mold spores and damp conditions can lead to respiratory issues and even make existing health problems worse, such as allergies, asthma, or immune disorders.

To mitigate dangers associated with water damage, landlords are recommended to take prompt action toward solving the issue at hand. In many cases, it may be best to seek the services of water damage restoration professionals who can handle water damage effectively and swiftly. If you have a San Diego property manager such as Good Life property management, then we can help you with your rental property.

Water Damage in an Apartment - Who is Responsible?

In California, the liability for water damage in an apartment can vary depending on a number of factors, including the cause of the water damage, the terms of the lease agreement, and local laws and regulations. However, some general principles can help clarify responsibility:

- If the water damage is caused by the tenant’s negligence, the tenant is responsible for the cost of repairs.

- If the water damage is caused by a defect in the property, the landlord is responsible for the cost of repairs.

- If the water damage is a result of natural causes, such as excessive rain, then the landlord is responsible, since the water intrusion likely occurred due to a defect in the property.

Tenant Negligence Water Damage in a Rental Property

- Failure to report leaks, such as a leaky faucet or roof.

- Improper use of fixtures or appliances, such as leaving a hose running or overloading an electrical outlet.

- Misuse of maintenance guidelines, such as not unplugging appliances before cleaning them or not using the correct type of cleaner on a surface.

- Failure to prepare for winter properly, such as not draining pipes or not turning off the water supply.

If water damage occurs due to tenant negligence, landlords should be notified immediately to assess the damage early on. In these cases, it is critical for both the landlord and the tenant to document all damages to the property with photographs and descriptions in writing. Doing this will help tenants file insurance claims for their damaged personal property, and landlords can also use their documentation to file insurance claims for structural repairs.

Tenant did not report water leak

If a tenant did not report a water leak in their rental property, it is likely that it has worsened over time and can cause significant damage. In cases of unreported water leaks, the tenant may be deemed responsible, depending on the cause of the leak.

Even though tenant are expected to report leaks and water damage, if the leak is in an area that is not reasonably visible, then the tenant is not liable for not reporting it. For instance, if a leak is under kitchen sink, where the tenant may be storing cleaning supplies that obstruct the view of the leak/water damage, then the tenant is not liable for failing to report it. Similarly, if there is a leak occurring in the attic that may not be visible in the living spaces of the house, then the tenant cannot be held liable for failing to report it.

Sometimes, tenants fail to report water leaks due to misunderstandings of their rights under California law or fear of consequences. However, California law provides tenants with protection related to habitability and repairs.

To encourage tenants to report water leaks promptly, landlords can foster a positive and communicative relationship with their tenants, starting with clear and easily accessible methods to report maintenance issues. Upon renting, landlords can also provide tenants with resources, such as maintenance guides or information materials to help tenants understand how to handle water leaks.

It’s always beneficial to both parties that landlords educate their tenants about their rights and responsibilities, including the tenant’s protection against retaliation for reporting any water leak issues.

Does landlord insurance cover water damage?

Landlord insurance can provide coverage for certain types of water damage, but the extent of coverage depends on the specific policy and the cause of the water damage. For example, most policies cover water damage caused by sudden and accidental events, such as a burst pipe or a leaking roof. However, some policies may not cover water damage caused by flooding or sewer backup. For flood coverage, landlords would need to seek a separate flood insurance policy through the National Flood Insurance Program (NFIP). It is important to read your policy carefully to understand what types of water damage are covered.

If you are unsure whether your policy covers water damage, you should contact your insurance company to ask. Some landlord insurance may also provide liability coverage. If water damage in your rental unit affects neighboring units or causes damage to the property, landlord insurance liability coverage may help protect from legal claims and associated costs.

Does renters insurance cover water damage?

Renters insurance, classified as an HO-4 policy in the insurance industry, provides coverage for tenants. There are three main types of coverage: Liability, Personal Property, and Loss of Use.

Liability coverage shields tenants from being held legally responsible for damages, excluding intentional or negligent acts like purposefully damaging property. Depending on the insurer, it may cover common liability claims such as medical expenses for a guest injured on the property, a tenant’s child accidentally breaking a neighbor’s window, or a kitchen fire caused by the tenant’s cooking.

Personal Property coverage safeguards the tenant’s belongings in the event of a covered loss, often arising from incidents like water leaks damaging possessions or theft. Additionally, it includes coverage for the cost of relocating or storing personal property to mitigate further damage to the home.

Loss of Use coverage, dependent on the policy, typically provides compensation in the form of a per diem, lump sum payment, or reimbursement to the tenant for any additional living expenses incurred due to a covered loss. For instance, if a home becomes uninhabitable due to a leak, and the tenants need to stay in a hotel, renters insurance may issue a payment to cover a week’s stay in the hotel along with extra meal expenses.

Landlord Responsibility water damage in rental property

According to the California Civil Code Sections 1941 and 1942, landlords have a legal responsibility to maintain their rental property in a habitable condition. This includes attending to water damage that is not a result of tenant negligence in a timely manner to prevent any extensive damage or health risks.

Since maintaining habitability is the landlord’s legal responsibility, landlords are responsible for any resulting structural damage caused by water damage. These structural damages may include damage to walls, roofs, ceilings, and flooring. If water damage has affected the rental property’s original structure, the landlord is responsible for repairing or replacing those materials. Therefore, landlords should have property insurance that covers the structural components of their rental property so that they can receive help with the costs of covered events.

Preventative measures can also help landlords avoid massive renovations. Preventative maintenance may include conducting regular inspections to identify and address potential water damage before it becomes a major and urgent problem.

If a landlord fails to meet their responsibilities regarding water damage, it can lead to legal disputes and potential liability. Tenants who believe their landlord is not addressing water damage issues in accordance with California law can seek legal advice or contact local housing authorities for assistance.

Landlord Responsibility for Flood Damage

When it comes to flood damage in a rental property, a landlord’s responsibility depends on what is causing the flood, where the flood occurred, where the rental property is located, and the terms outlined in the lease agreement with their tenants.

Regardless of the cause of flooding, landlords first have a responsibility to maintain a habitable and safe living environment for their tenants. If flooding renders the rental unit uninhabitable or poses safety risks, the landlord is typically responsible for addressing these issues.

The degree of flood risk and landlord responsibility may vary depending on where the rental property is located. Properties located in flood-prone areas may be subject to additional regulations and requirements, and landlords may be required to reveal these flood risks to tenants ahead of time. In some cases, local building codes may dictate flood-resistant construction measures for properties in flood zones.

To clarify who is responsible for water damage and when, lease agreements should specify the responsibilities of both the landlord and tenant regarding maintenance and repairs. In some cases, landlords may include clauses related to flood damage in the lease agreement. It’s essential for both parties to review the lease agreement carefully to understand their obligations.

Although landlords are responsible for maintaining safe living environments for their tenants, landlords are not generally required to carry flood insurance for rental properties. However, flood insurance is a separate policy that property owners can purchase through the National Flood Insurance Program (NFIP) or private insurers.

Landlord Insurance Water Damage

Landlord insurance, also known as rental property insurance or landlord’s dwelling insurance, typically covers a range of risks and damages that landlords may encounter when renting out their properties. Having landlord insurance is essential for property owners who rent out their properties, as it helps protect their investment and provides financial security in case of unexpected events like water damage.

Landlord insurance can help protect landlords from financial losses caused by water damage to rental property. However, the extent of coverage for water damage can vary depending on the insurance policy. That’s why it is important to read your insurance policy carefully to understand what is and is not covered.

For example, some insurance policies will require you to purchase additional coverage for water damage caused by natural disasters, such as flood insurance. The coverage specifics, including policy limits, deductibles, and premiums, can vary widely depending on the insurance company and the specific policy chosen. It’s important for landlords to review and understand their policies thoroughly.

Difference Between Landlord Insurance and Homeowners Insurance

A landlord policy, often referred to as a homeowner policy (either HO-6 or HO-3), offers similar protections, although insurance companies may label them differently and tailor the coverage to suit the specific needs of landlords or homeowners. Both policies encompass a range of standard protections, yet there are notable differences in the extent of coverage. Typically, a landlord policy may feature lower provisions for property damage, different liability safeguards, and increased coverage for loss of use. It’s important to note that due to their shared classification as HO-6/HO-3 policies, it is not possible to have both a homeowner and a landlord property policy in effect at the same time.

Certain insurance providers present the option of a DP-3 policy for rental properties in lieu of an HO-3. DP-3 policies are designed for homes that serve as secondary residences, like rentals or vacation homes. They share similarities with HO-3 policies, offering coverage for the structure or dwelling, liability, and loss of use. However, DP-3 policies generally provide limited or no coverage for personal property. It’s important to note that DP-3 policies may not be suitable for all properties, as they typically exclude coverage for additional structures on the property, such as fences or detached garages.

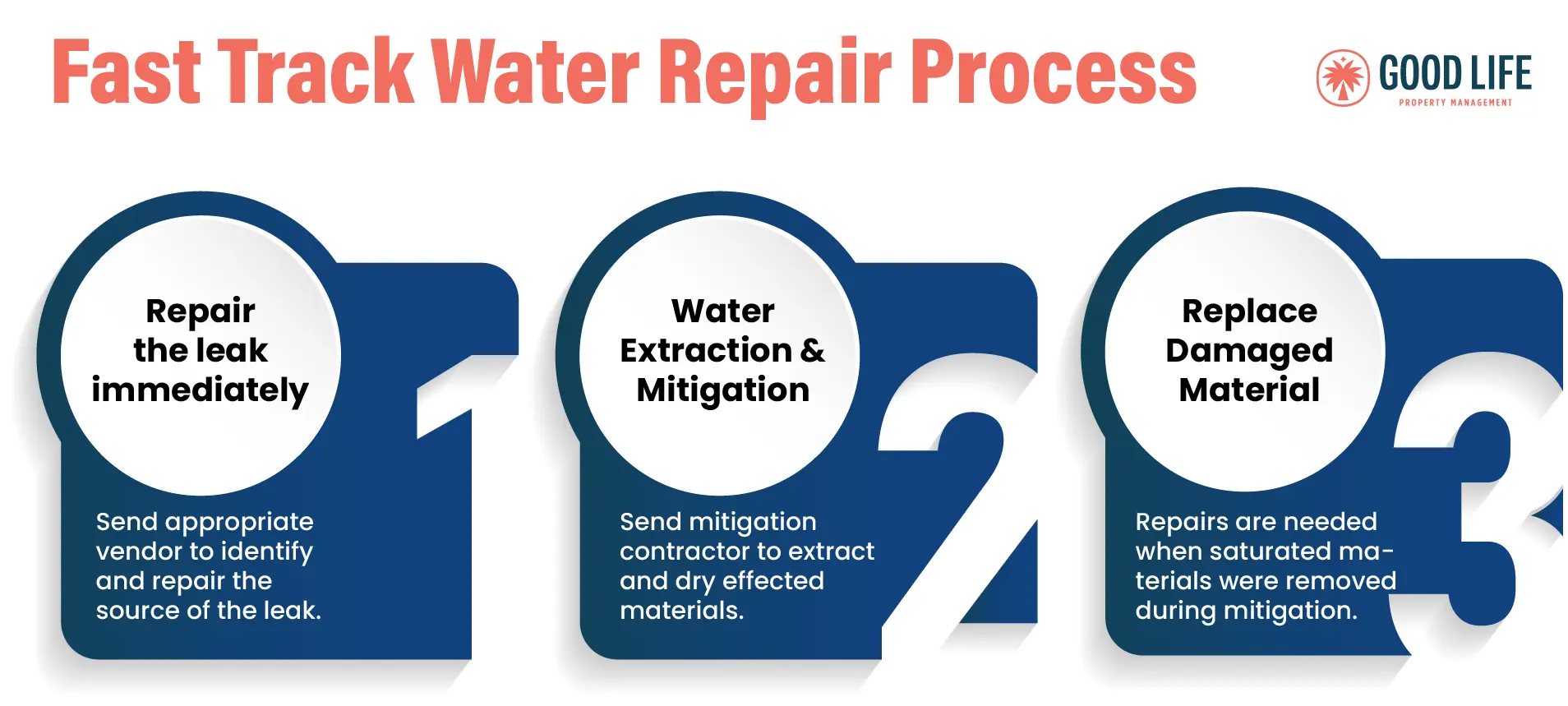

Good Life Property Management Fast Track Repair Process for Water Damage

- Repair: For a water damage incident, the first step is to repair the issue causing the damage. This could be as simple as replacing a failed wax ring on a toilet, replacing a water heater tank, or repairing a leaking section of piping.

- Mitigate damages: Depending on the severity of the damage, a specialized water damage contract may be needed to prevent the home from further damage. For a water leak, this typically involves cleanup (required for grey or black water), removing damaged or non-salvageable material (baseboards, flooring such as carpet or laminate flooring, drywall, etc), and drying the remaining material to prevent mold growth.

- Replace Damaged Material: Items removed in the mitigation steps are replaced (patching/painting drywall, replacing flooring, etc).

How we Fast Track Repair water damage in your rental property

When maintenance issues are reported that potentially qualify as a Fast Track Repair (FTR), your Good Life maintenance coordinator will initiate an FTR. These maintenance issues could be property damage, habitability issues such as broken windows, no hot water, leaks, etc. The Fast Track Repair process will upgrade the maintenance issue to a priority status and alert your Good Life property manager. (Note: this is different from most routine maintenance, which is able to resolve without the property manager’s assistance.)

Important note: We do not seek approval or obtain estimates for mitigation. Since it’s an urgent matter, our management agreement allows us to proceed with whatever measures necessary to protect your property.

Your Good Life property manager and maintenance coordinator will be constantly monitoring the job progress and updating the tenant and owner as needed until completion. Our staff is trained to document the timeline of the repair process thoroughly. In the event that insurance becomes involved or rent credits are needed to be issued to the tenant, these documents will become very helpful.

Insurance Claims

Should the homeowner file a claim with their insurance for property damages, Good Life can handle almost the entire process. Homeowner would list the property manager as the point of contact and property manager will be able to provide all the necessary information and documents the adjuster may need (date of loss, cause of loss, contact info for contractors/vendors working on the project, HOA documents, arranging for adjuster site-inspection, copies of related invoices).

Once the claim is filed by the homeowner (only the policy holder can initiate the claim), insurance will generally send the funds directly to the homeowner to cover the mitigation and repairs. Then, the only other action needed from the homeowner is disbursement of those funds (either to Good Life staff, who will disburse the funds to vendors, or directly to vendors and contractors).

Rent Credits

Should the loss/incident affect the tenant’s reasonable use of the property, they are generally entitled to a reduction in rent. Since there are many factors involved, there is no set formula that either Good Life or insurance companies use to determine rent credits. Generally, if the entire property was uninhabitable, a full rent credit would be issued.

Loss of Use coverage is typically optional on most homeowner insurance policies, but payout varies by insurer. Some insurance companies reimburse the homeowner a dollar-for-dollar amount equal to the rent credit given (up to the limits on the policy). Other insurance companies may only offer reimbursement of the loss rent if they deem the entire property to be uninhabitable. For example, loss of use of the kitchen or only bathroom would qualify as uninhabitable.

Regardless of insurance policies, tenants are entitled to fair rent credit if, for no fault of their own, they have partial or complete loss of use of their unit.

Frequently Asked Questions (FAQs)

How long does a landlord have to fix water damage in California?

According to the California Civil Code, landlords must fix urgent water damage that renders the property uninhabitable or imposes a health hazard on the tenant immediately.

If the water damage is not urgent and does not impose a health or safety risk, landlords have 30 days to fix the water damage. If landlords do not conduct repairs within 30 days, tenants can file a complaint with a government enforcement agency, such as the Department of Public Health or their local Department of Building and Safety.

Tenants can also go ahead and perform the repairs on their own and then subtract the cost from their rent. Landlord failure to fix water damage can also lead tenants to stop paying rent or to vacate their property immediately without any obligations listed in their lease [CA Civil Code Sec. 1942]. If the property damage is substantial and landlords have failed to maintain the property, landlords cannot demand that tenants pay their rent, either [CA Civil Code Sec. 1942.4].

Do I have to rehouse my tenant if I make repairs in California?

In California, if you, as a landlord, need to make repairs that render a rental unit uninhabitable, you generally have certain responsibilities regarding rehousing your tenant during the repair period. These responsibilities are outlined in California tenant-landlord laws, specifically in the California Civil Code, and are designed to ensure that tenants are not left without a place to live while necessary repairs are being made.

Lease Agreements in California usually address what happens in the event that a leak or water damage causes the property to become dangerous or uninhabitable. Typical language in California leases would note that the lease may be terminated by the landlord or tenant depending on who has the right to cancel. For example, if the property was partially destroyed due to the tenant’s negligence versus a natural disaster.

If the landlord asks tenants to move in order to make repairs, the landlord must:

- Provide the tenant with comparable temporary housing nearby or, if that’s not possible, pay the difference between the current rent amount and the new rent elsewhere for up to 4 months.

- Pay the tenant’s moving expenses.

- Insure the tenant’s personal property in transit or pay for damages incurred to personal property while in transit.

- Pay for the setup of utilities

- Give the tenant the first chance to move back in once the repairs are completed

The above noted expenses for tenants are not typically covered under a landlord’s insurance policy.

If the landlord fails to provide the tenant with a written notice and agreement, the tenant may be able to withhold rent until the landlord complies. The tenant may also be able to sue the landlord for damages. For more information on tenant-landlord laws in California, please visit the California Department of Housing and Community Development website.

Can a tenant refuse to pay rent if repairs are needed in California?

Does landlord insurance cover water damage?

- Water damage that occurs suddenly and accidentally is generally always covered under landlord insurance. Insurance typically covers property damage and landlord belongings that were used for repair.

- Water damages caused by floods, earthquakes, and sewer water backups are usually not included in landlord insurance policies.

- If the water damage is caused by a landlord’s failure to fix a leak over an extended period of time that leads to significant damage, landlord insurance will not cover the damages.

Is a tenant responsible for water damage?

Who is responsible for a water leak in a rented property?

Is a landlord responsible for water damage to a tenant’s property?

If you found this article helpful, follow us on social media. We post daily tips to help you manage your own rental property:

Further Reading

We hope you found this article helpful! For more articles on landlord tips, check out:

How Much Does Property Management Cost?

Short-term Rental vs. Long-term Rental: 12 Things to Know

Service Animals & Emotional Support Animals: What Landlords Need to Know

Steve Welty

Subscribe to our Weekly Newsletter

Join the 5k+ homeowners receiving Local Law Updates and Landlord Tips. Delivered to your inbox every Saturday at 6am PST.

Share this:

Get in touch with us:

Choose Your Next Step

Good Life Blogs

We believe that education is empowering.

Pros and Cons of Hiring a Property Management Company

Read about the pros and cons of using a property management company to manage your rental properties. In this article, we touch on what makes a property management company beneficial but also why some people might be hesitant to hire.

Pros and Cons of Rent Control

The subject of rent control has become increasingly popular over the last couple decades. As rent prices continue to skyrocket across the country, more and more tenants get priced out of their homes and neighborhoods. This is why the majority of tenants are in favor of…

Section 8 in San Diego: How It Works

Rental assistance in San Diego is a hot topic as of late. Many landlords and property managers have heard of Section 8, but don’t know all the ins and outs of the program. As of January 2020, all landlords and property managers are required to accept Section 8 housing vouchers as a form of income…