What is the California Home Insurance Crisis?

2025 Update

As a leader in property management, Good Life has been closely observing the California home insurance crisis over the past few years. These changes are more than just industry trends. Rather, they directly impact the way homeowners and property investors will approach their insurance needs in California.

In recent years, California’s home insurance landscape has undergone substantial changes. These new changes are reshaping how homeowner’s approach insurance in the golden state. Collectively, these compounding circumstances have caused the California home insurance crisis.

Marked by increasing insurance rates, regulatory challenges, natural disasters, and the withdrawal of some insurance companies from the state, this crisis is increasing homeowners insurance in California across the board. In this article, we will explain the challenges and considerations of California’s new home insurance environment.

Table of Contents

Understanding the California Home Insurance Crisis

Over the last few years, the California home insurance market has embodied the “hard market,” a term used to describe a state of the market where consumers have limited negotiating power. This shift in power is largely due to changing interactions between insurance companies, regulatory bodies, California’s broader economy, and the environmental landscape.

Who Determines Home Insurance Pricing?

Home insurance pricing is created by insurance companies and regulatory bodies. Regulatory bodies are government agencies or organizations that enforce laws and regulations in California to maintain fair market practices.

When it comes to home insurance, regulatory bodies serve the following functions:

- Set standards and guidelines for home insurance companies to follow.

- Approve rates.

- Uphold consumer protection policies.

- Oversee the market.

- Oversee licensing and compliance of insurance companies and agents.

Insurance companies and regulatory bodies work together to establish fair and sustainable rates. However, there are currently several factors that are disrupting the balance and accessibility of the insurance market in California.

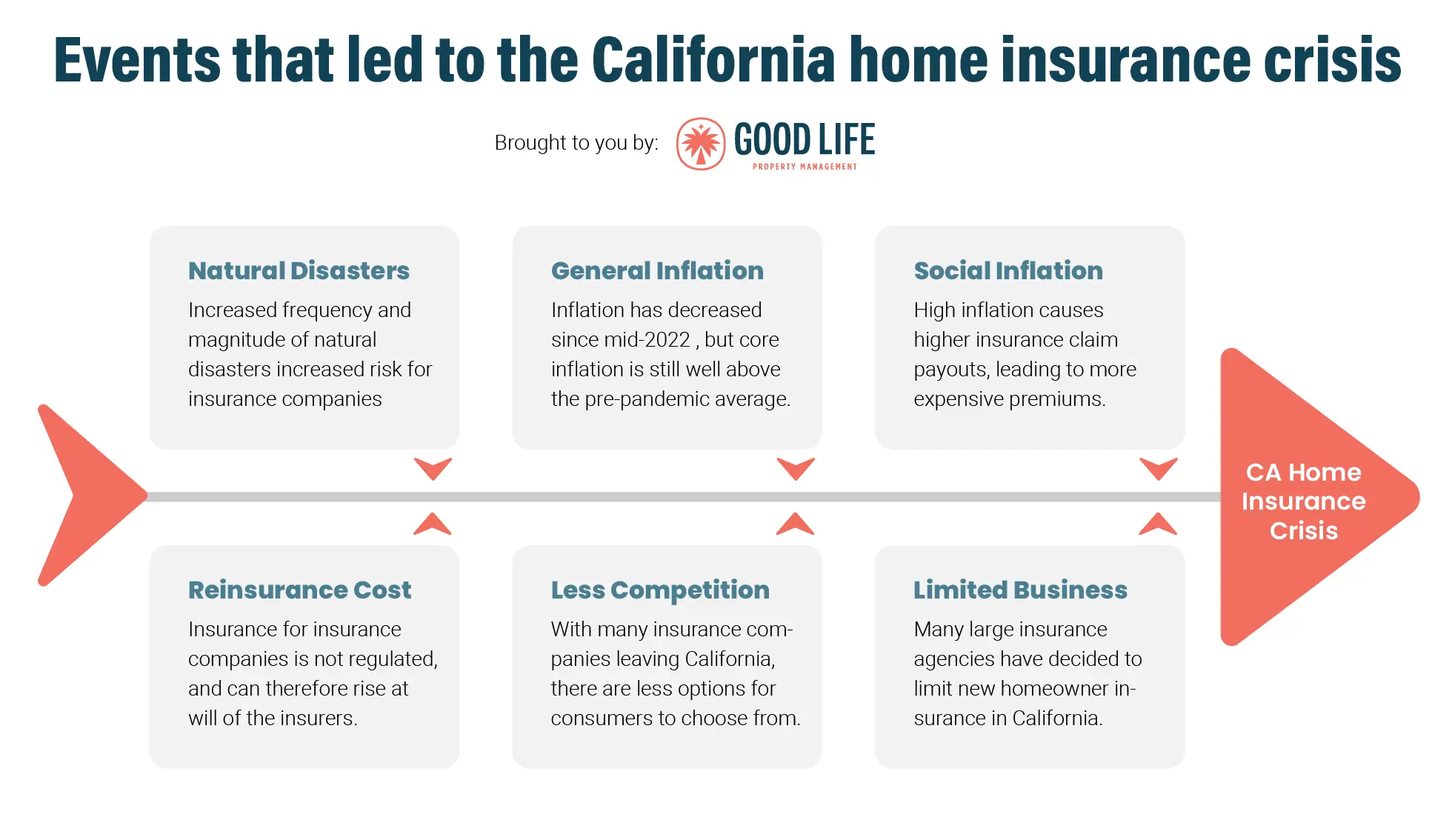

What Factors Have Led to the Home Insurance Crisis in California?

Increased frequency and magnitude of natural disasters

Over the past decade, California has experienced a notable increase in the number and magnitude of natural disasters. Collectively, these natural disasters contributed to the California home insurance crisis.

Over the past few years, California has become notoriously known for catastrophic wildfires that have caused widespread devastation. Some of California’s largest and most destructive wildfires have occurred during the last ten years. For example, the Camp Fire of 2018 covered an area of 153,336 acres and destroyed almost 20,000 structures.

In response to the growing wildfire threats, California has enacted policies and legislation to mitigate fire risks, support affected communities, and manage forest health. However, these policies and legislation haven’t regulated home insurance prices.

Insurers, now facing enormous claims from these natural disasters, have had to reassess their risk models and pricing. Unfortunately, this led them to increase their premium prices and, in some cases, not insure homes in high-risk areas.

Moreover, the threat of earthquakes has always been a concern that further complicates the California home insurance crisis. The rise in natural disasters prompts insurance companies and regulatory bodies to modify policies, often resulting in stricter criteria and increased costs for homeowners. These changes reflect an industry grappling with the realities of climate change and its impact on insurance viability in California.

Coastal floods and earthquakes are two other significant hazards affecting the California home insurance crisis. Both of these natural disasters can cause significant property damage and disrupt local economies.

General inflation and rising cost of reinsurance

Another factor that has led to the California home insurance crisis is general inflation. Consider the following example: when a house burns down during a high inflation period, the costs of construction materials and labor will increase the payout amount for the insurer. In turn, the cost of general inflation is reflected in insurance premium prices for homeowners.

Related to this specific example is the cost of reinsurance, or insurance for the insurance companies. Yes, even insurance companies need insurance! This protects them from large-scale losses, particularly the ones seen from increasing wildfires in California. As wildfires and other natural disasters increase, reinsurance costs also rise.

Social inflation

Social inflation refers to the trend of steadily rising insurance claims, a phenomenon that is becoming more prominent in California. This is exacerbated by increased litigation and judgment awards in lawsuits that require insurance companies to pay large sums of money to the defendants.

Some societal trends feed into this phenomenon, too, particularly against large corporations. For example, when the public harbors a negative sentiment towards insurance companies, policyholders tend to sue them for larger amounts and often hire aggressive legal representation. Likewise, juries might be influenced to vote in favor of homeowners, causing insurance companies to pay higher amounts than in previous years.

This situation is being compounded by changes in broader litigation strategies. For example, California is seeing a rise in third-party litigation financing, where outside parties fund lawsuits in exchange for a portion of the settlement.

As insurance companies struggle to keep up with these changes, the impact trickles down to homeowners.

Regulatory bodies, responsible for maintaining a balance between fair insurance prices and helping insurance companies remain in business, are finding themselves in a challenging position. They strive to ensure that insurance companies can sustainably cover claims for their clients while maintaining fair home insurance rates. However, the impact of all these factors have caused regulatory bodies to establish high interest rates, which has caused home insurance to rise quicker than inflation.

* Click to enlarge

Causes and Consequences of Insurance Companies Leaving California

A rising number of insurance companies have left California, which has imposed severe implications for homeowners.

There are several reasons why insurance companies are leaving California, but the most prominent are higher claims and higher losses. Insurance companies are affected by regulatory challenges, market conditions, financial viability, rising reinsurance costs, and consumer impact. The state’s strict regulations make it particularly difficult for insurance companies to adjust their rates fairly in response to increasing risks that drive high claims and losses. In other words, insurance companies have struggled to profit in California and are deciding to leave the state.

Fewer insurance companies in the state means less competition and fewer consumer choices. As such, consumers are experiencing challenges in finding coverage options that fit their needs, and when they do, these options are often at higher prices. This is particularly challenging for homeowners who live in high-risk areas prone to natural disasters.

Insurance companies leaving California, along with increasing factors that are escalating claim risks, are intensifying the volatility of an already rapidly evolving market. These changes fuel disagreements between homeowners, insurance companies, and regulatory agencies, particularly over pricing issues and future market projections.

Latest Developments in California Insurance News

List of homeowner insurance companies that are limiting business in California or have left all together

At the time of this wiring, here is a list of insurance companies that have limited business in the golden state, or have left all together.

Responses From Insurance Companies and Government Bodies

As the market continues to change, insurance companies and regulatory government bodies are reevaluating their strategies to keep up. On the one hand, insurance companies are struggling to make a profit and are faced with difficult regulatory challenges. On the other hand, regulatory agencies and government bodies in California are trying to balance the financial viability of insurance companies and protect their consumers. This has sparked a critical debate over how to set future projections.

While insurance companies emphasize the need to consider recent trends and escalating events, such as the increasing severity of wildfires, regulatory bodies caution against relying solely on past events as definitive predictors of the future. The resolution of this debate will shape the future landscape of insurance in California.

Insurance Companies Are Not Being Protected, and Some Are Pausing New Business

As mentioned earlier, insurance companies rely on reinsurance to help them pay their claims. While homeowners and consumers are protected by regulatory bodies and government agencies, insurance companies are not. As such, reinsurance companies are able to set their rates as they like. Although regulatory bodies aim to protect consumers, constraints set on insurance companies limit the companies’ ability to adjust their rates in response to changing market conditions.

Since this situation is preventing insurance companies from being profitable, some insurance companies have chosen to pause issuing new policies in California. For instance, State Farm, one of the major carriers, has not left California entirely but has stopped issuing new homeowner insurance policies. This decision was a major headline in the California insurance news and industry. State Farm’s statement published on May 26, 2023 cited its departure resulted from increased construction costs, growing catastrophe exposure, and a challenging reinsurance market.

New Insurance Protections for Consumers

In 2022 and 2023, California introduced new laws to enhance consumer insurance protections. Key legislative measures include SB 1040, which empowers the Insurance Commissioner (the state’s insurance department) to take action against those selling insurance without proper authorization, especially targeting scams.

Additionally, SB 1242 strengthens the fight against insurance fraud by ensuring insurance agents and brokers receive proper training on spotting and reporting fraud. This bill also requires insurance agents receive continued education, finger printing, and list their license number in emails.

How to be Successful during the California Home Insurance Crisis

As California’s home insurance landscape evolves, homeowners must take a careful, informed approach in their search for an insurance provider. This section delves into strategies and insights for effectively navigating the home insurance market. We’ll explore practical steps for selecting appropriate insurance coverage, managing rising costs, and staying ahead of regulatory changes so your home can remain well-protected.

Interview Insurance Agencies

In a fast-evolving market, it is crucial that you choose an insurance agency that understands your specific needs, unique circumstances, and/or financial constraints. For example, if you live in an area that has been or is prone to natural disasters such as wildfires, you should look for an agency with a proven track record specializing in properties in high-risk fire zones.

Here are some key questions and considerations to guide you:

- How long have you been providing home insurance in California, and do you specialize in any particular type of property or area?

- Can you share examples of how you’d handled policies for homes in high-risk areas?

- How well do you understand the specific risks associated with my area or property type?

- How do you determine the right level of coverage for a property like mine?

- Can you walk me through your claims process? How are claims handled, and what is the average resolution time?

- What support do you offer homeowners during the claims process?

- How are your insurance premiums calculated, and what factors might affect my rate?

- Are discounts available, such as for home security systems, fire resistance, or long-term loyalty?

- How do you keep your clients informed about changes in their policies or new regulations?

Understand Challenges in High-Risk Areas

The designation of high-risk areas in California primarily concerns regions vulnerable to wildfires, earthquakes, and floods. Owning property in these zones will pose difficult challenges, especially when obtaining insurance coverage and managing high premium costs. Regions prone to wildfires, such as Southern and Northern California, are particularly vulnerable. The rising frequency and severity of wildfires in these areas have made it difficult for homeowners to find companies willing to provide coverage.

Similarly, areas near fault lines, like the San Andreas fault, are classified as high-risk zones for earthquakes. Homeowners in this region might find that standard insurance policies do not cover earthquake damage, requiring them to purchase additional (often expensive) earthquake insurance. Furthermore, certain coastal areas in California are considered high-risk due to their vulnerability to flooding. Similarly to earthquake insurance, flooding insurance is not always included in standard homeowner insurance policies.

If you are a homeowner in these areas, it is essential that you conduct thorough research and understand the specific risks associated with your property’s location so that you can find proper coverage for your home.

Seek Experts Who Help You Understand Policy Details

Along with a personalized approach, you should look for agents and companies willing to walk you through your policy. Be sure that you understand the ins and outs of your policy, such as limitations, exclusions, policy changes, and risk assessments.

When insurance policies are impacted by legal and regulatory changes, things get even more complex. Working with someone who takes the time to explain how these changes impact your policy will give you peace of mind. State regulatory laws might change what your current policy is able to cover, so understanding and keeping up with regulatory changes will keep you protected.

Maintain Long-Term Relationships With Insurance Companies

Maintaining a long-term relationship with your insurance agent or company can be beneficial in such a volatile market. If you have worked together for a long time, your insurance company will have a complete scope of your insurance history and specific needs, leading to a more personalized and efficient service. Such familiarity also facilitates a smoother and quicker claims process.

Furthermore, loyalty often comes with perks; many insurers offer discounts to long-standing customers. Having a long-term relationship with your insurer also means that your coverage can be adjusted more readily as your needs change.

Additionally, staying with the same insurer can save you from the hassle and time involved in switching providers, negotiating new rates, and familiarizing yourself with a new policy. In cases where you are thinking of switching companies, make sure to try to communicate your needs and talk to your insurance agent first. A sustained relationship with your insurance provider will foster trust, better communication, and can lead to financial advantages in the long run.

If you found this article helpful, follow us on social media. We post daily tips to help you manage your own rental property:

Steve Welty

Subscribe to our Weekly Newsletter

Join the 5k+ homeowners receiving Local Law Updates and Landlord Tips. Delivered to your inbox every Saturday at 6am PST.

Share this:

Get in touch with us:

We make owning rental property easy.

Choose Your Next Step

Good Life Blogs

We believe that education is empowering.

Pros and Cons of Hiring a Property Management Company

Read about the pros and cons of using a property management company to manage your rental properties. In this article, we touch on what makes a property management company beneficial but also why some people might be hesitant to hire.

Pros and Cons of Rent Control

The subject of rent control has become increasingly popular over the last couple decades. As rent prices continue to skyrocket across the country, more and more tenants get priced out of their homes and neighborhoods. This is why the majority of tenants are in favor of…

Section 8 in San Diego: How It Works

Rental assistance in San Diego is a hot topic as of late. Many landlords and property managers have heard of Section 8, but don’t know all the ins and outs of the program. As of January 2020, all landlords and property managers are required to accept Section 8 housing vouchers as a form of income…