Working with many rental property owners, I’ve noticed that there’s often a gap in understanding the full benefits of owning rental properties. Most people get the basics like cash flow and appreciation, but there are three other powerful ways real estate can build your wealth that often get overlooked.

Here are the five distinct ways real estate can build your wealth:

Cash Flow, Appreciation, Tax Savings, Amortization, and Leverage.

1. Cash Flow

Cash flow is the net income from your rental property after all expenses are deducted. Here’s how to calculate it:

Cash Flow = Rental Income – Expenses

Expenses include mortgage payments, property management fees, repairs, maintenance, utilities, insurance, and vacancy costs.

For instance, maintenance and capital expenditures can account for 10%-25% of the annual rental income, depending on the property’s age and condition. Accurately accounting for these expenses ensures realistic cash flow projections, preparing you for better investment decisions.

2. Appreciation

Property values generally rise over time, particularly in high-demand regions like Southern California. Appreciation can provide substantial returns on investment. For example, a 5% annual appreciation on a $1,000,000 property results in a $50,000 increase in value each year.

Cash flow investors often don’t understand appreciation investors, thinking they’re crazy for not focusing on immediate cash returns. They believe you buy for cash flow and treat appreciation as a bonus. Conversely, appreciation investors don’t understand cash flow investors, as they are accustomed to property values rising.

The truth is, both strategies work. Over a long timeframe, markets typically see a 5-6% annual increase. So, your million-dollar property could make you $50,000 a year on average. In contrast, a property in the Midwest worth $135,000 might only appreciate to $15,000 over five years, yielding a much smaller return.

3. Tax Savings

Tax benefits are a significant, yet often misunderstood, advantage of owning rental real estate. A key tax advantage often not understood is depreciation.

Annual Depreciation = $500,000 / 27.5 = $18,182

Expense Deductions: Deductible expenses include repairs, maintenance, property management fees, and travel expenses related to property management. These deductions can significantly reduce taxable income, often allowing investors to show a loss on paper despite positive cash flow.

4. Amortization

Amortization is the process of gradually paying off the mortgage through monthly principal and interest payments. Each payment increases your equity in the property.

If your monthly mortgage payment includes $1,500 towards the principal, this amount builds your equity which is paid for by the tenant. Even if your property shows a negative cash flow of $500 a month. Thus, the real financial benefit could be viewed as +$1,000 when considering the equity gain.

5. Leverage

Leverage involves using borrowed capital (a mortgage) to increase the potential return on investment. This strategy allows you to control a larger asset with a smaller initial investment.

For a $1,000,000 property, a $200,000 down payment and $800,000 financing mean you gain $50,000 in equity from a 5% appreciation, based on the full property value, not just your initial investment.

Additional Leverage Benefits:

Home Equity Line of Credit (HELOC): You can use the equity in your property to secure a loan for renovations, improvements, or to purchase additional properties, all while deferring taxes on the borrowed equity.

Why is this important?

Owning rental property is not always easy. It’s our mission to make it easier for you. When real estate is not a stress in your life and is working as intended, it becomes an incredible wealth-building tool. However, it takes time, so you need to stay in the game.

One way to help avoid burnout is knowing all the ways your investment is paying you. You might not be getting the cash flow you want right now, but you’re still benefiting from amortization, leverage, tax savings, and appreciation. Understanding these benefits can keep you motivated and focused on the long-term rewards.

Why We Rent Out Our Properties

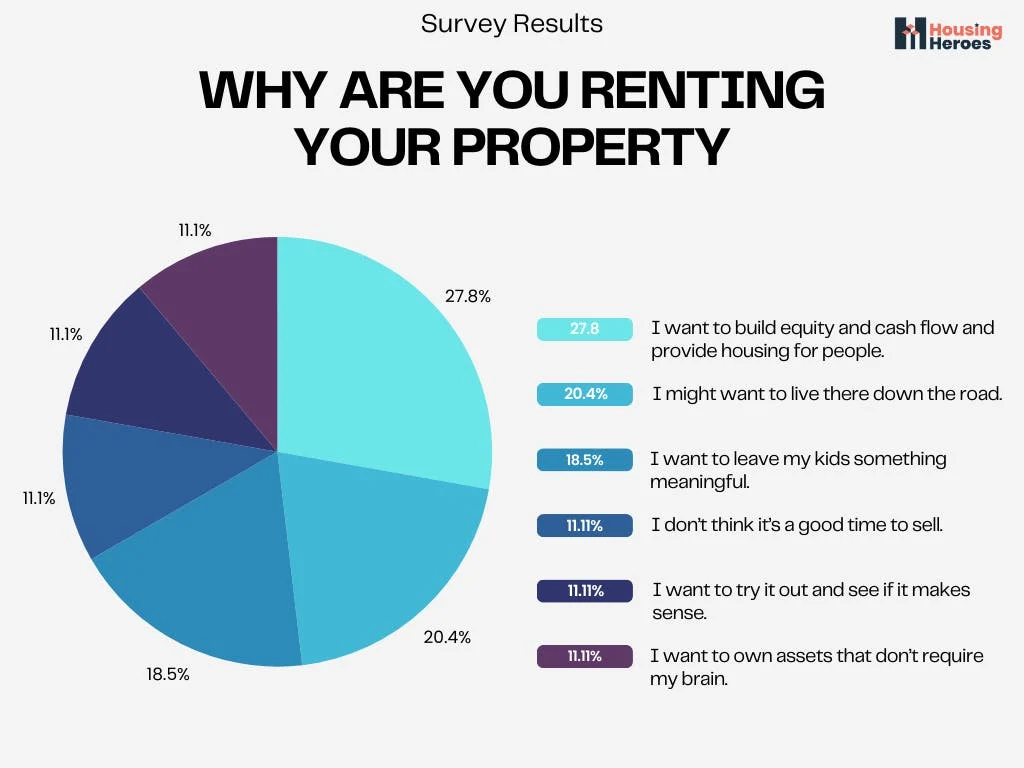

We recently conducted a survey to understand the motivations behind why we rent out our properties. Here are the results:

Steve Welty

Subscribe to our Weekly Newsletter

Join the 5k+ homeowners receiving Local Law Updates and Landlord Tips. Delivered to your inbox every Saturday at 6am PST.

Share this:

Get in touch with us:

We make owning rental property easy.

Choose Your Next Step

Good Life Blogs

We believe that education is empowering.

The State of the San Diego Housing Market in 2022

The San Diego housing market has experienced a lot of change over the past couple years. What is the state of home sales and rental properties now?

Rental Property Repairs: Landlord vs. Tenant Responsibilities

When it comes to rental property repairs, the responsibility burden between landlord and tenant can quickly lead to a finger-pointing battle. In this blog post, we cover everything you need

California Balcony Inspection Law: A Comprehensive Guide (2025)

California’s Balcony Inspection Laws should be on your radar if you own a building with three or more units and elevated exterior elements over six feet.